If renting or communal living no longer align with your financial and lifestyle goals, you might be ready to purchase a home of your own.

Are you sick of paying monthly rent that contributes to someone else’s mortgage payment? Are you craving the freedom to repaint walls? Or, are you looking to build wealth through what is often considered a smart investment? If so, it sounds like it may be time to start your homebuying process.

Consider these six reasons that help affirm you’re ready to become a first-time homebuyer.

1. You crave the freedom to personalize and renovate

Owning a home gives you the freedom to express yourself by completely customizing interior and exterior spaces. You no longer have to abide by regulations regarding wall colors or hanging art.

Additionally, you can remodel and renovate your home as you see fit. From small projects, like changing cabinet pulls, to big projects, like tearing down a wall or adding hardwood floors, you have the authority to make decisions regarding design.

2. You’ve outgrown your space

An obvious reason to move is when you’re tight on space. For many, this could be because you’re expanding your family – think a baby on the way, more pets, aging children who want their own bedrooms or in-laws that are here to stay.

A shift in lifestyle patterns, like working from home and online schooling, means you may be on the hunt for more quiet workspaces. And, if you have hobbies or own outdoor equipment, it may also be time to assess your storage needs – like an attic or garage.

3. You seek outdoor accessibility

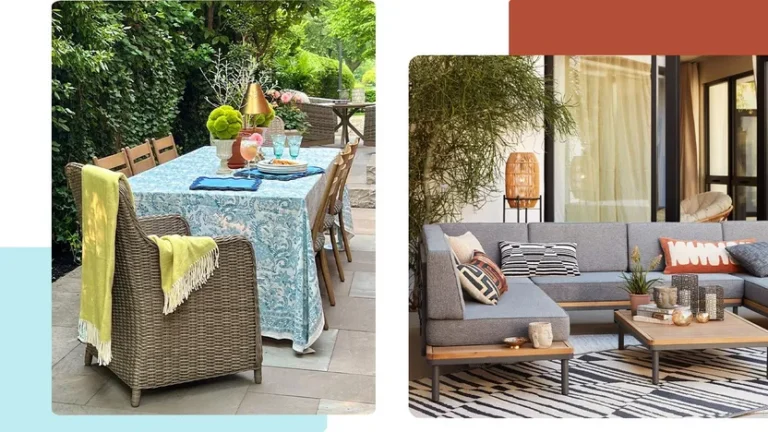

In apartment living, outdoor space is limited – and sometimes crowded. When you buy a home, a criterion may be a grassy yard, deck or patio space. Whatever your preference may be, you’re likely seeking a way to enjoy the outdoors with privacy.

Having your own outdoor space means room for entertaining and room for exercise. Plus, you can accentuate the curb appeal of your home with exterior décor like potted plants, flower boxes, furniture and seasonal holiday flare.

4. You’re done with fees and rules

A major downside to renting is paying for a property that you do not own, and therefore is not your personal investment. Apartment fees go toward necessary services, like garbage disposal, but also may contribute to amenities you don’t use, like a gym or pool.

Additionally, apartment communities often have time restrictions and limited hours on resources you would like to take advantage of.

5. You’re ready to make an investment

Have you been saving for a down payment? Though the initial cost can often be a barrier to entry for first-time homebuyers, the down payment may not need to be as high as you think.

Once you’ve saved enough money for that initial investment, however, the monthly costs associated with homeownership can be similar to what you would have paid in monthly rent. Only this time, your payments contribute to your property becoming an asset. The more you pay off your mortgage, the more valuable your home is to your personal net worth.

6. Long-term happiness

One of the biggest reasons to purchase a home is for the stability and security it provides you and your family. You can truly settle into the space and life can slow down a bit.

With the ability to personalize most aspects, and by thinking of it as a long-term investment, a home of your own becomes the place you cross milestones, celebrate holidays and create lasting memories.

Article originally appeared on RE/MAX.