The outcome of buying a house in a seller’s market can be downright spooky for some. Here’s how buyers can ensure they’re purchasing the right house with the right support along the way.

Skipping a home inspection? Spending over budget? Those could end up being nightmare real estate situations. Thankfully, taking preemptive steps during the home search process could help prospective homebuyers avoid feeling haunted by an uninformed or spontaneous decision when buying a house.

Elizabeth Baker, an agent with RE/MAX Southern Shores in Charleston, South Carolina, is no stranger to clients selling because their house doesn’t meet their needs – sometimes after living there for decades and sometimes soon after moving in.

“Buyer’s remorse is a very really feeling,” says Baker, who works mostly with home sellers these days. “But there are things buyers can do – like extensive research and working with an experienced real estate agent – to help guarantee they’ll be happy in their new home.”

Baker and a residential home inspector share their best practices for prospective homebuyers.

Research, research, research

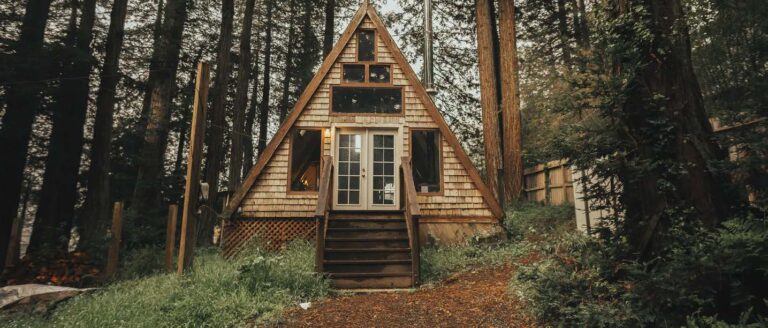

Does the location get feet of snow in the winter but no sun – or reach scorching hot temps in the summer? Is there space to walk a pet dog? Consider more than just the house itself when deciding if a location is the best fit.

Just because a home is within city limits or in a sought-after neighborhood does not mean it fits a buyer’s day-to-day life or is easily accessible to nearby points of interest. Researching the general area, as well as the hyper-local neighborhood, of a prospective home is a great way to assess if commute times and proximities to school or work are manageable.

Without walking the streets or visiting the property, it can be difficult to gauge whether a home is nestled in a quiet area or along a busy thoroughfare. For those buying a home sight unseen, it’s essential to utilize tools like a “street view” visualizer and read up on local news to get an idea for the area’s walkability, community and culture.

Don’t skip the inspection

Inspections identify the large- and small-scale issues of a prospective home, from a leaky faucet to a crack in the foundation. Sometimes, findings from the inspection can turn off a buyer or nudge a seller to make repairs before the sale closes. However, in a seller’s market with low inventory, desperate buyers are willing to do almost anything – including waive the inspection – to purchase a home, leaving them with a mysterious, and potentially hazardous, situation at hand.

“An informed buyer is going to be a happy buyer in the long run,” says Andrew Gonzalez, owner of HouseHawk Inspections in Salt Lake City, Utah, a residential home inspection service. “It all comes down to information, and the more information you can get on a subject, the better decision you can make.”

While the inspection process is predominantly based off of visual cues, Gonzalez advises buyers to hire an experienced professional in the field. Some buyers think they can assess a property themselves but face a harsh reality as they aren’t trained to look for warning signs.

“Typically, we can see signs of large issues,” he says of home inspectors.

Baker agrees that waiving the home inspection could be a surefire way for clients to experience buyer’s remorse, finding necessary repairs after the sale closes that they hadn’t budgeted for.

“Waiving home inspections is becoming a popular trend and people are getting stuck with homes that need a new roof, need a new HVAC system or they end up having underlying septic issues. Replacing the septic alone can cost you [around] $50,000,” she warns.

Gonzalez debunks a common misconception that home inspections are only essential in older houses. A new construction home, he says, is just as deserving of an inspection to ensure the builder hasn’t cut any corners in structure, function or safety.

“A newly built home should be as close to perfect as possible,” Gonzalez says.

Find a seasoned professional

A real estate agent does so much more than show homes. A qualified real estate professional streamlines a daunting process while providing advice, using time-backed tactics tailored to the current housing market, and can translate real estate and legal terminology to be digestible for their client.

“The majority of RE/MAX agents [are] full-time agents, not part-time agents who make only two sales a year,” Baker says. “You want somebody who actually knows what they’re doing because as the buyer, you might not know any better and might let the sellers be in charge while you get no say.”

To find the most compatible agent, search for local professionals and speak with multiple to figure out the best match. In a seller’s market, the homebuying process can be exhausting – so it’s important to have compatibility and honest communication along the way.

Stay on budget

Sticking to a strict budget – and shopping for less than the limit – provides a better chance of winning a sale in a fast-paced market, and also saves money for renovations and customizations down the road. An essential first step for those purchasing a home with a loan is to get pre-approved for a mortgage. Doing so will show the sellers that the buyer is serious, but it will also provide a number that will set parameters on how much the buyer can spend.

“Make sure upfront that you have a budget and then shop below that budget so if you do need to go against other offers or implement an escalation clause, you’re not already at the top of your budget,” Baker says.

Keep an open mind

Amid high turnover and an influx of cash buyers, it’s important to not get too attached to one property – and stay as patient as possible along the way. In the case of getting outbid, other properties could fail to live up to expectations. Instead, make a realistic and refined list of “wants versus needs” and use it as a guiding compass.

To avoid experiencing buyer’s remorse, shop with the identified “needs” top of mind. If buying under-budget and continually saving, those features that are considered “wants” can likely be added at a later date. But necessary components like square footage and quantity of bedrooms are difficult to compromise on – and can lead to outgrowing a home quickly and regretting the purchase altogether.

Article originally appeared on Remax.com.